crypto tax calculator nz

Work out your cryptoasset income and expenses. Its important to keep good records for all your transactions with cryptoassets.

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

We are Chartered Accountants who specialise in cryptocurrency taxation.

. Reflects dividend being taxed at a rate of 33. The world of cryptocurrency and taxation is a murky one. Crypto CPAs in New Zealand.

How is crypto tax calculated in Australia. Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting.

We have a list of certified tax accountants in New Zealand that specialize in cryptocurrencies. Straightforward UI which you get your crypto taxes done in seconds at no cost. Simply copy the numbers into your annual tax return.

Some cryptoasset transactions may not have an NZD value such as. Over 500 integrations with support for complex scenarios such as DeFi NFTs. Crypto Tax Calculator.

Buying crypto is not a taxable event see example 2 below. Calculate the New Zealand dollar value of your cryptoasset transactions. Exchanging your cryptoassets for different cryptoassets.

They use software to keep a record of all your trades so that you can easily convert them into AUD equivalents. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event. All New Zealand residents are taxed in their income but non-residents can also be taxed if their crypto-asset income has a source in NZ.

Log in with Google. Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc. Using crypto to purchase goods or services is a taxable event.

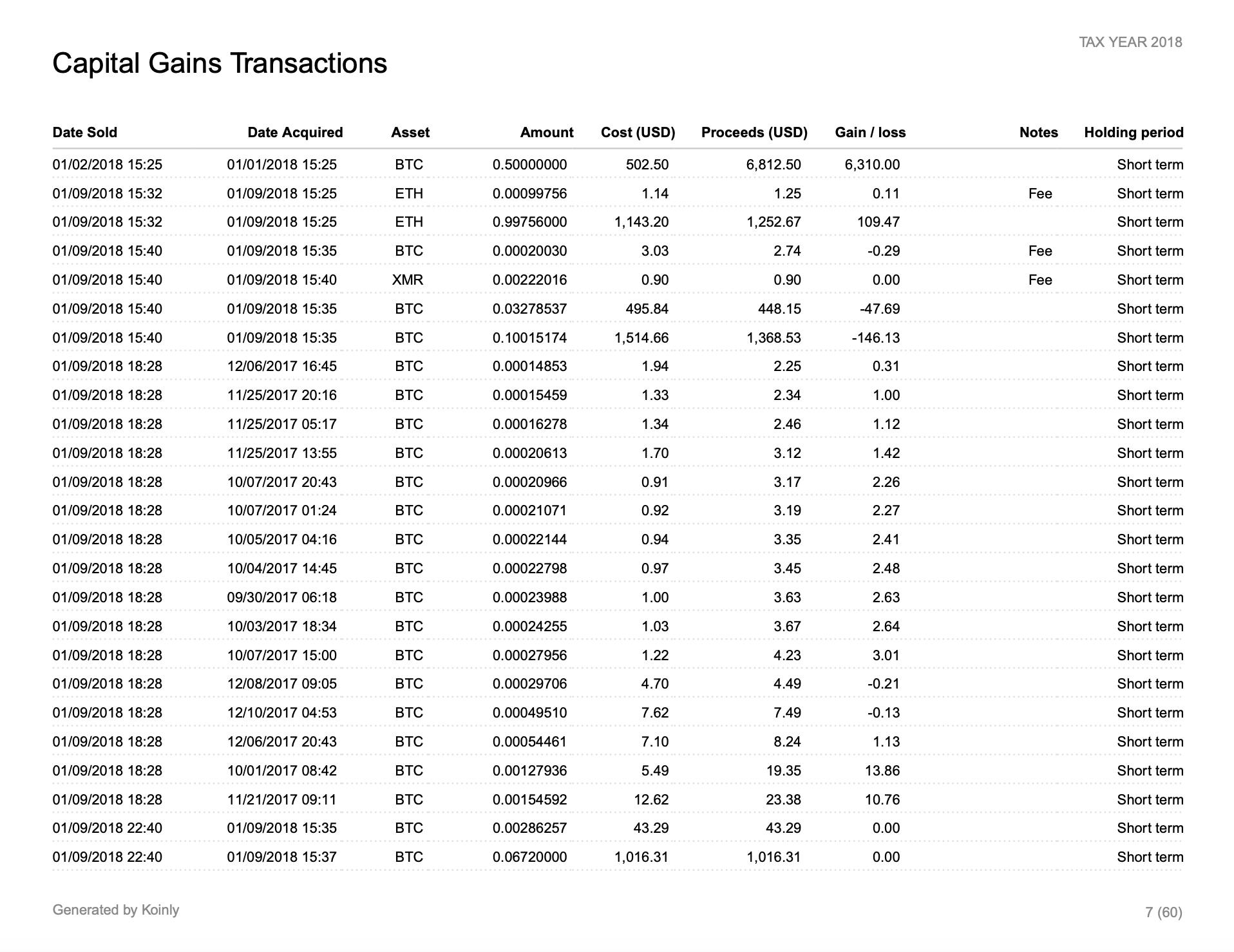

Contact us today to discuss your situation and how we can help. Cryptocurrency Tax Calculator. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

07 823 4980 or email us. CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. CryptoTaxCalculator 1354 followers on LinkedIn.

Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets. Online Crypto Tax Calculator with support for over 400 integrations. Check out our free guide on crypto taxes in New Zealand.

Log in to your account. You need to use amounts in New Zealand dollars NZD when filing your income tax return. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains.

The form then helps you calculate if you have paid too much tax or not enough. If youre converting between crypto and non NZD currencies you cannot use the apps NZD converter as it probably wont be the same as conversion rates released by the IRD for the tax conversion purposes. Taxoshi NZs Crypto Tax Caluclator.

If you held cryptoassets that were stolen you may be able to claim a deduction for the loss. Receiving mining or staking rewards. Income report - Mining staking etc.

With the end of tax year coming up on the 7th of July next month Taxoshis automated. A If you are a tax resident Taxed on worldwide income including cryptoasset income from overseas. Mining staking income.

Calculate the net dividend youll receive for a given NZX listed company based on the number of shares you own. Our step by step wizard and cryptocurrency tax calculator is fine-tuned for New Zealand and will help you figure out your crypto tax position to declare. Sort out your crypto tax nightmare Crypto taxes can be painful but with our easy-to-use tool you can prepare your taxes in a matter of minutes.

Online Crypto Tax Calculator with support for over 400 integrations. Calculate and report your crypto tax for free now. Alternatively Swyftx partners with both Koinly and Crypto Tax Calculator who offer crypto tax reporting services to taxpayers in Australia.

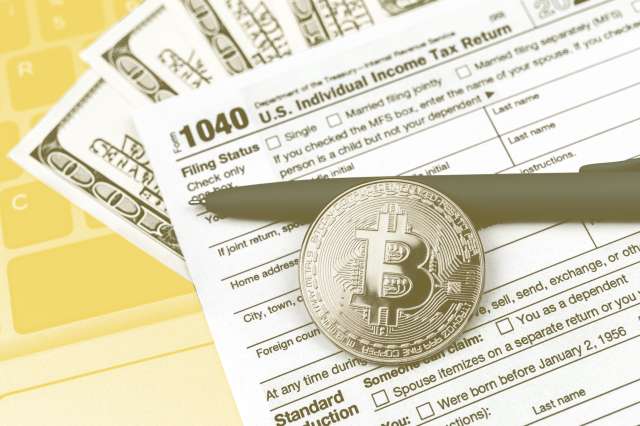

The tax treatment of crypto assets first became a hot issue in 2016 when the price of bitcoin rose from US500 to US1200 and continued to climb strongly to almost US20000 by the end of 2017. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. Calculating the New Zealand dollar value of cryptoassets.

Miningstaking Income report. Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax calculation service that makes it easy for you to meet your NZ Crypto tax obligations. File your crypto taxes in New Zealand Learn how to calculate and file your taxes if you live in New Zealand.

B If you are new or returning tax resident after 10 years Eligible for a 4-year temporary tax exemption on most types of foreign income. After the end of the tax year 31 March you need to file an IR 3. An unrealised profit is when the market value of a token is higher than the original purchase price.

Morris says releasing an updated guide is a good opportunity for people to review the tax positions they have taken previously and make voluntary disclosures if their income from crypto-assets hasnt. Capital gains tax report. Completing your tax return.

Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. You may be eligible for a tax refund if your tax rate is lower or may owe tax if. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

Generate complete tax reports for mining staking airdrops forks and other forms of income. We have a range of services available for investors traders miners and businesses involved with cryptocurrency. See our 500 reviews on.

In this you include all of the income you have made in the year from all sources including wages dividends cryptocurrencies etc and all of the tax you paid. 49 for all financial years. For New Zealand customers we recommend reading our 2022 NZ crypto tax guide.

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Koinly Vs Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

Cryptocurrency Tax Reports In Minutes Koinly

Tax Time Blue Tinted Image Of Calculator And Figures On Paper Selective Focus Ad Tinted Image Calculator Tax Time Ad Tax Time Tax Calculator

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Crypto Tax Calculator Review April 2022 Finder Com

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Crypto Tax Calculator Review April 2022 Finder Com

I Built An Income Tax Calculator Using Formidable Forms For The Cook Islands Govcrate Blog

Koinly Crypto Tax Calculator For Australia Nz

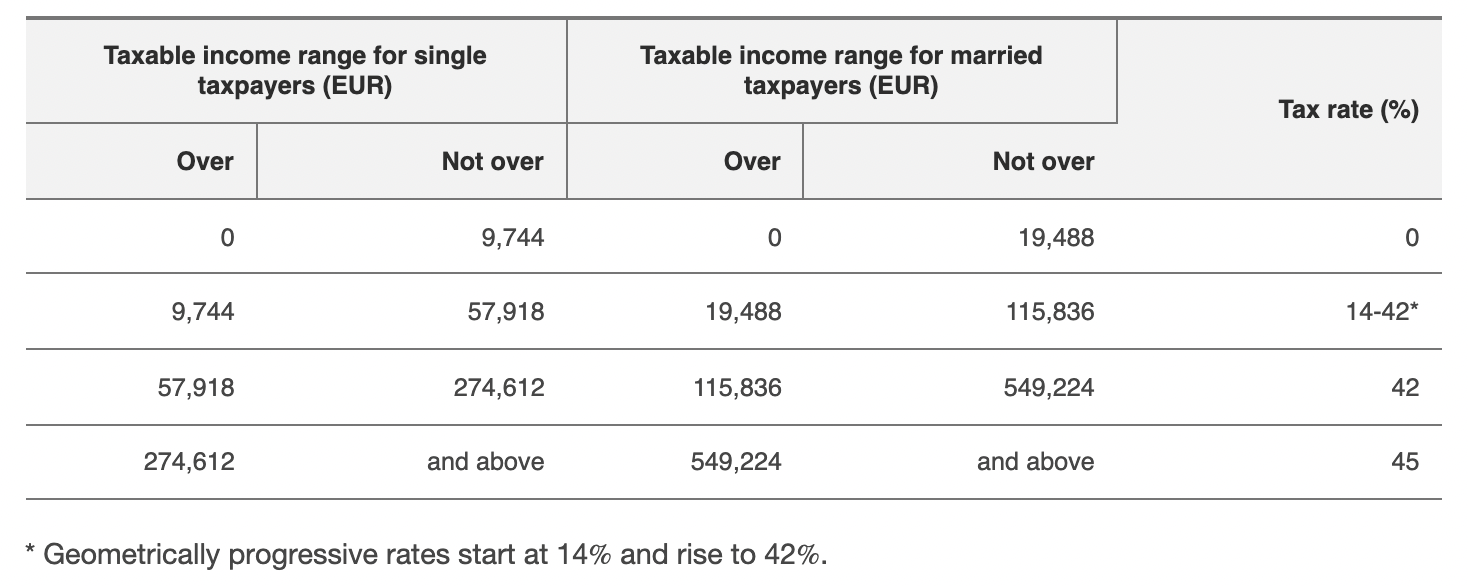

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

A Capital Gains And Tax Calculator R Ausfinance

Cryptocurrency Tax Reports In Minutes Koinly

Cryptocurrency Taxes What To Know For 2021 Money

Capital Gains Tax Calculator Ey Us

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money